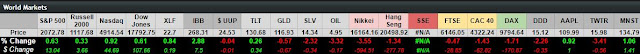

Stock indicies were down for the week, while oil is attempting a comeback.

/ES istesting its 10ma and is in between necklines for vM to 2006.75 and vW to 2087.75

Also has a gap at 2088.25

Expecting higher if can hold above vM neckline and recent low at 2026 hold 2026.

The Russel is testing its 10MA as well. vW to 1140.9 is triggered.

vM's to 1074.8 and 1038.3 are formed which look like good entries if using stops just below.

Ultimately looks like it wants higher towards 1308

Nasdaq has vW's 4627.75 and 4851 that are triggered. All time highs are 4739.5

The Dow is testing neckline for vW to 19653

Oil rebounded heavily and has retaken its 10ma. vW to 41.65 is triggered, which is also at the 200ma. If price can hold above the 200ma and break above 42.49, expecting vW to 44.09 and gap at 45.22 to hit. A break above 42.49 will also null vM's towards the low $30's.

The Dollar continues grinding down towards vM's to 93.86 and 92.84

Needs to hold that $93-92.50 area to avoid further selling towards vM to 89.38, which is triggered.

Bonds still looking very strong and above all ma's which could be bad for stocks.

Needs to avoid acceptance above 177

Gold has been in a short term downtrend but has retaken its ma's. See if can break above recent highs at 1287.8 which will null vM's to 1166.7 and 1125.3

Copper has gotten hit the past several days but below vM target price at 2.1052

Ma's and MACD not looking pretty. Will need aggressive bounce to turn them around.

XLF has vW to 21.59 that is triggered, inside vW's to 22.99 and 23.46 which are also triggered.

IBB has nulled short term vM's to 239.02 and 232.62

vW's to 298.04 and 318.19 are triggered.

The CME Group fell over 8% this week.