Stocks sold off this week with several days down over 1%. All indexes except the Nasdaq are below their 200ma's.

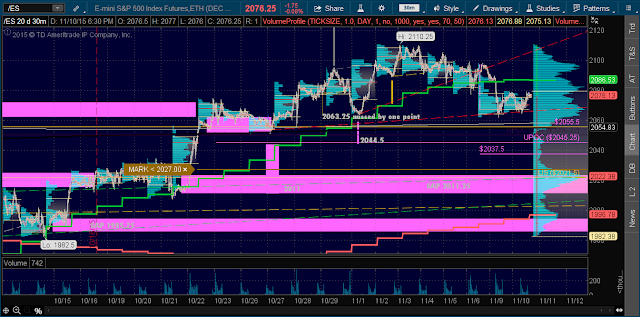

/ES was down over 1.3% and sitting just above a gap at 2011.25 and a vM to 2011. It could not find support and its 200ma. The 50ma is at 2000.

/ES larger time frame has a huge vM to 1571.5, and vW to 2345.75 that have formed. If the /ES can hold 8\24 crash levels and make new highs, the vM to 1571.5 will be nulled. If the /ES does break below crash levels, the vM to 1571.5 will be triggered.

The Russell closed below its 50ma. 200ma is converging towards the 252ma. vM to 1038.1 is triggered, which if hits will have triggered 849.1

The Nasdaq is still above its 50ma.

Dow

Nikkei 225 just above 200ma

IBB tanked Thursday afternoon, printing a huge candle, hitting 311.64, then rebounding.

XLF

$

Bonds trying to regain 10ma.

Gold fell into vM target price of 1075.7 this week. See if can hold 1072.3

Oil likely to dip below $40 towards $39.02. Next support is the gap at $36.25, then vM to $33.07, then $18.93 if cant hold $33.

Copper well below 8\24 crash levels.