Stock indexes rallied Friday closing higher for the week. Stock indexes have aslo regained their 10ma's but still well below 50 and 200 ma's. Bonds and gold closed slightly higher for the week. Oil also continues its bounce, but has hit a vW price target at 33.78

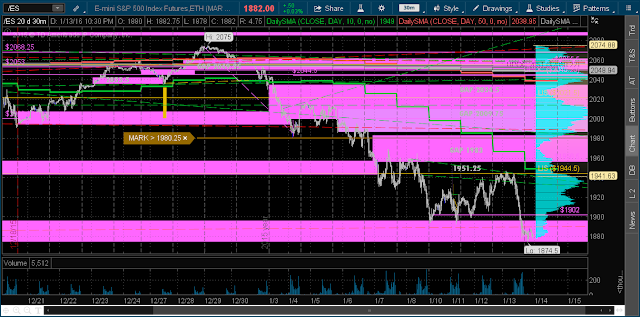

/ES has vW's from 1949.25 to 2040.75 that are triggered. Break below 1804.25 nulls all. vW to 1982.25 has a gap just above at 1983 which might be a reversal point.

Long term /ES still has vM's to 1629 and 1571.5 formed. New highs will null.

Russel has vW's to 1073 and 1092.8 that are triggered. Gap at 1089.9 just below vW target price 1098.8 may be reversal point.

NASDAQ

DOW

Nikkei

The Dollar is still riding its 10 and 50 ma's

Bonds close to hitting vW target price at 168'17. See if pushes through or reverses lower.

Gold is approaching it's 200ma while showing hourly negative divergence on the macd. Watch to see price and the 10ma can push above the 200ma.

Oil continues its bounce, but has hit vM at 33.78. VW to 38.61 is still triggered. Price is testing vM neckline for 18.29

Copper looking bullish and testing 50ma. Possible double bottom forming towards 2.35