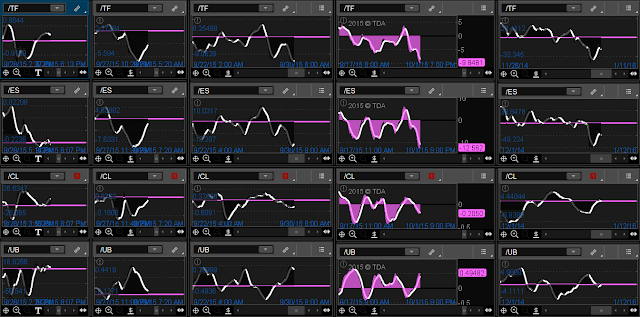

Bonds rallied while U.S. markets were down heavily, along with Europe, metals, and oil. The dollar was down also, but just fractionally. IBB led the way again closing down over 6%. China and Hong Kong were able to reverse at the end of their trading day and closed up slightly. S&P and the Russell have fallen to vM target prices. Markets need these levels need to hold, and reverse from here to avoid testing crash levels, and likely lower! Unfortunately the Nasdaq and Dow still have room to go towards vM's lower. See if S&P and Russell can pull them up. September 9th's high at 2011.75 is current Bull v.s. Bear line, and any rally will be suspect until that is breached..

/ES fell 1 tick above vM to 1869.5. Needs to hold this level to avoid testing crash levels and likely lower. vM to 1817 is triggered. Needs close above 2011.75 to null.

The SPY hit vM 188.21, see if can hold here, if not 180.46 on the radar. Below 187 triggers vM to 157.02

SPY Long Term

UPRO

SPXU

/TF fell hitting vM target price at 1088.7, triggering a vM to 1061.2. !!!NOTE!!!The Russell's ETF., the IWM made new lows v.s. the futures, breaching the crash levels on 8\24. None of the other index ETF's did that.

IWM

Nasdaq fell through vM to 4149.25...looks headed to 4027.25

The DOW appears to have more downside towards 15692, if that doesn't hold, 15388. Will need bullish price action from S&P and Russell to hold it up.

IBB fell over 6% through vM 296.41. August 24 lows are 284.16, it is sitting at 290.61

XLF hourly MACD below zero. vM to 21.06 triggered.

The Nikkei hasn't closed below 8\24 lows, but it has dipped below them. A close below 17170 will null vW's to new highs.

The Dollar is still trading in between converging ma's.

Bonds look headed to 162 area.

Gold still holding above 10ma.

Oil needs 1hr MACD to be above zero. 10ma currently above 50ma.

Copper nearing 8/24 lows.

AAPL needs 111.10 to hold to avoid selling towards vM 105.85

DDD getting hit lately. Needs to hold $11 which is 8\24 lows.

WBA has vM to 68.13 which looks like a good entry for a run towards vW 111.42(63.5%). Would look to stop if breaks below 66.10(3.07%)