Stocks fell heavily, possibly/partially on China devaluing the Yuan. The indices gave back most yesterdays rally. A late day rally did close them off their lows. Could likely be very volatile next several sessions.

/ES back below 10 and 50 ma's. 10ma has been dragged back below 50ma. Could easily fill yesterdays gap at 2099.5 tomorrow or following sessions. Expecting 2080 to become a balance area unless makes a quick directional move one way or another.

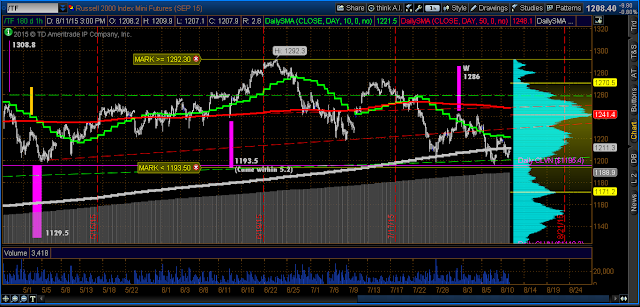

Russel is still below all ma's. Needs to hold 1190 area.

Nasdaq back at 50 ma.

Dow below all ma's. 10ma<50 and 200 ma's. 50 and 200 ma's near death cross (50ma<200ma)

Nikkei 225 took back all of yesterdays gain.

XLF sitting at 10ma. Also gave back all of yesterdays gains.

IBB gave back yesterday as well.

The VIX futures are sitting just above the 10ma. Looks like wants to test 50ma.

The Dollar looks like it want to test the 50ma, but overall looks to be in an uptrend.

Seeing the Euro futures makes me rethink my dollar thesis...we'll see. It is above 10ma, MACD is positive, and 10 and 50 ma's look constructive.

Bonds rallied about 1.5%

Gold broke out of balance to the upside. 1130 on radar, and possibly a test of the 50ma at 1140-ish.

Oil fell over 3% breaking the $43 handle.

Copper gave back all of yesterdays gains, and made new lows.

Unless AAPL can hold recent lows, 108.67 on the radar.

DDD looks like good buy at $12.20 area with a stop under $11.49

Gap fill at $85.93 appears to be on radar for WBA unless hits $90.44 head and shoulders pattern target price and reverses.

Pandora looks bullish if its ma's remain constructive.

No comments:

Post a Comment