Stock indexes fell heavily in the am, then reversed around mid-day, then were boosted into the green by the fed minutes(which were released about 15 minutes by a Bloomberg error), only to close down around 1% near the lows of the day. Oil plummeted over 5% to lows not seen since 2/18/2009.

/ES is below its 10 and 50 ma's, and just above its 200ma. The SPY and UPRO closed above the 200ma but after the close, during ETH they fell below the 200ma. A break below 2046.75 nulls short term vW's, and a break below 2034.25 will null vW to 2205.25.

The Russel is back below its 200ma. Needs to hold 1185.2, otherwise expecting 1129.5

Nasdaq back below 10 and 50ma's. It doesn't look as weak as the others, but if the others fall, it will as well.

The Dow remains below all ma's. 16927 looks imminent. If can't hold that, expecting 16191.

The NYSE remains below all ma's. Cross of the 50ma below the 250ma looks imminent.

XLF seesawing between ma's as well. Kind of resembles the Nasdaq.

IBB continues below all ma's

AAPL's double bottom not looking so good.

The Nikkei fell heavily, almost nulling its short term vW to 21300. If cant hold 20055, expecting further selling towards 19700 area.

The Dollar fell back below its 50ma.

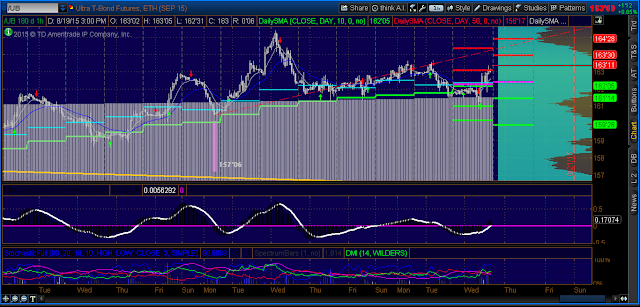

Bonds back above 200ma, along with the 10ma.

Gold hit a vW to 1130. They aren't pretty, but have some to 1137 and 1151 areas.

Oil (OCT - /CLV5 contracts) fell below $41 to levels not seen since 2\18\2009. Levels below $40 that could bounce from are vM to 39.06, a gap filled at 36.25, and a vM to 31.58.

Pandora looks bullish here. Above all ma's, and ma construction looks bullish.

BTU launched 25% on news that George Soros was buying. Interesting read on it. http://www.foxnews.com/us/2015/08/19/billionaire-george-soros-warms-up-to-coal-as-stock-prices-hit-bottom/

No comments:

Post a Comment