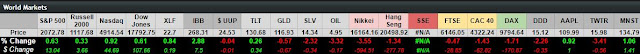

U.S Stock indices closed up for the week after an April fools selloff. The Nikkei 225 closed down 5% for the week after worse than expected manufacturing data, but U.S. Indices didn't follow suit. Oil closed down over 7% for the week , along with the Dollar which was down about 1.8%

/ES has vW to 2070 and 2075.5 triggered. Also has W to 2084.75 and a Gap at 2088.25

Russell: Expecting some reversal attempts at Gap 1030.2 and vW's to 1119.3-1140.9, but think will ultimately set up for new highs. vW to 1308 is triggered.

Nasdaq has 4627.75 on the radar

The Dow needs to get above 18334 to null vM to 13402. vW to 19653 has been triggered.

The Nikkei fell over 7% following lower than expected manufacturing data. Needs to hold 14815 to avoid further selling towards 13000.

Oil futures fell over 7% for the week. $32.29 on the radar. Next support is $30.56 and after that will likely test $26 area. If that fails expecting $18.92. Oil will need to break above and hold the 200ma in order to null these.

The Dollar was down about 1.8% for the week nulling vW to 98.80

93.86 and 92.84 on the radar

Bonds still have vW to 158'30, however price is holding above ma's

Gold has vM to 1166 triggered, and looks set to trigger 1125.3

Copper has small vM to 2.1052 triggered, inside a larger vW towards 2.7582

XLF

IBB has vM's to below recent lows but aren't triggered. Price testing neckline to trigger vW to 298.04

No comments:

Post a Comment